The Case for Trade Finance

Finance and Funding Process

1. An initial review of the business opportunity-by phone or in person. 2. Upon submission of appropriate information, an initial financing and/or marketing development plan will be formulated. 3. Formal proposal, after a survey of the market to determine success. 4. Implementation of the plan |

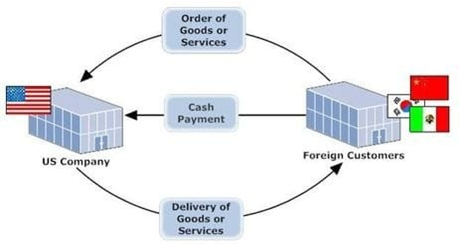

Cash in Advance

• Payment before shipment

• Most beneficial to exporter

• Eliminates non-payment risks

• May lose customers to competitors who offer payment terms

• Recommended for high-risk trade relations

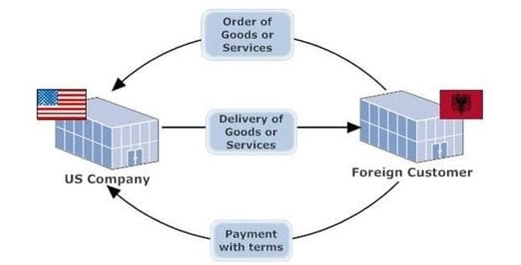

Open Account

• Payment with terms after shipment received

• Most beneficial to importer

• Increases competitiveness

• Significant exposer to non-payment

• Additional costs associated with risk mitigation measures

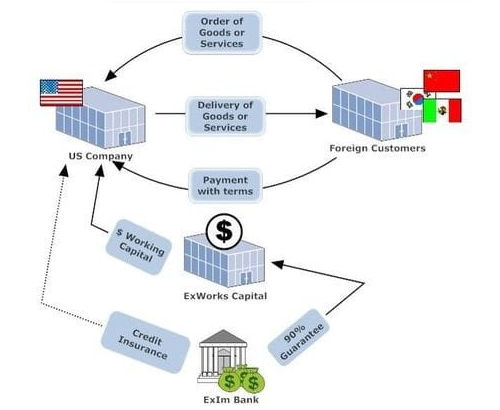

Working Capital

Extend revolving lines of credit or transaction specific loans to U.S. exporters comfortably working internationally to assist them in fulfilling overseas purchase orders and/or permitting them to extend more aggressive terms to their overseas buyers. These asset-based loans will provide for advance rates of up to 75% against export purchase orders (i.e. Inventory–Raw, WIP, Finished Goods) and up to 90% against accounts receivables from overseas buyers.

Uses

• Allows funds for materials, labor, inventory, goods and services for exports.

• Single or multiple buyers.

• For specific short-term transaction or as a revolving line of credit.

• Exporter may get credit insurance to reduce non-payment risk.

• The ability to obtain a working capital loan is dependent on the quality and strength of he U.S. company, the foreign receivables, and export related inventory.

Export Trading Company

Many SMEs in the U.S. are still uncomfortable conducting business internationally and would prefer to outsource this function to an expert. ExWorks can handle procurement, logistics, and structuring appropriate trade terms with foreign buyers and then buy the goods from the U.S.-based SME–ex works–like any domestic customer and take all of the risk.

• We have the ability to handle procurement, logistics, and structuring appropriate trade terms with the foreign buyer.

OR

• We can buy goods–ex works–like any domestic customer and take all the risk in selling overseas.

• Willingness to act as a trading company will depend primarily on the strength of the foreign buyer, the type of goods or services being purchased, and the economics of the trade.

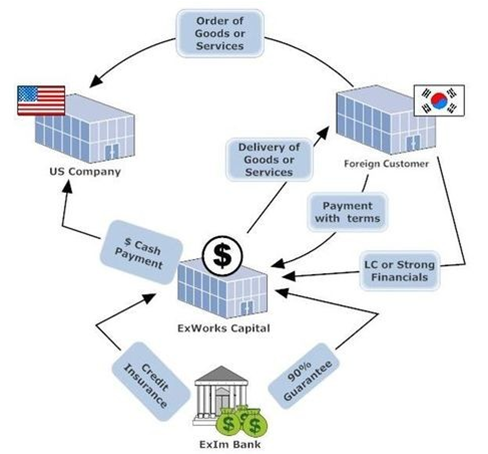

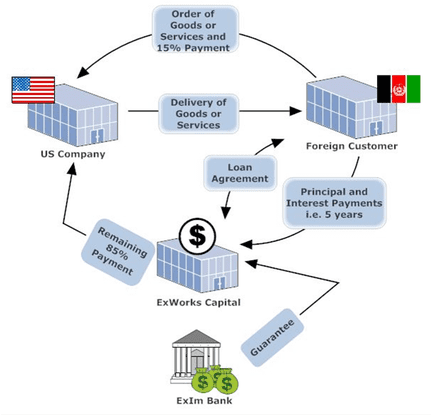

Term Financing to Overseas Customers

Make loans ranging from two to five years or more to overseas buyers of goods andservices from a U.S. exporter. Since the ability to provide financing on capital goods or large transactions is often required to make the sale,the ability to provide this type of financing to the buyer can substantially enhance a U.S. company’s ability to compete globally.

Term Loans to Foreign Customers

• Expands export opportunities to high-risk emerging markets.

• Provides medium and long-term loans directly to foreign customers, which enhances sales package of U.S. company.

• U.S. company paid in full upon loan disbursement to foreign buyer.

• Supports 85% of the U.S. contract price depending on U.S. content value.

• The ability of foreign customers to obtain a term loan is dependent on the quality and strength of its financial statements, possible county limitations, and size and nature of the goods or services purchased